Managing personal finances is a challenge for most individuals, especially in a country like India where expenses vary drastically across cities, lifestyles, and income groups. Among several budgeting strategies, the 50:30:20 rule has gained global popularity for its simplicity and effectiveness. But does this rule really work in the Indian context? Let’s explore the concept, its application in India, and whether you should follow it.

What is the 50:30:20 Rule of Budgeting?

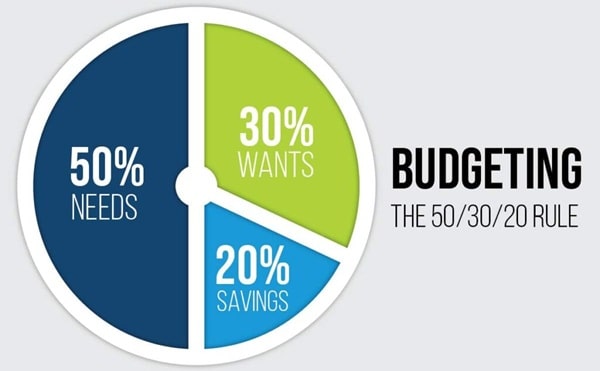

The 50:30:20 rule is a simple budgeting formula that divides your after-tax income into three broad spending categories:

- 50% on Needs: These are essential expenses that you cannot avoid, such as rent, groceries, utility bills, EMIs, transportation, and medical costs.

- 30% on Wants: These include lifestyle expenses like dining out, movies, shopping, travel, OTT subscriptions, and hobbies.

- 20% on Savings & Debt Repayment: This part of your income should go towards investments, emergency funds, loan pre-payments, insurance premiums, or any financial goal.

This rule was popularised by U.S. Senator Elizabeth Warren in her book “All Your Worth: The Ultimate Lifetime Money Plan” and is widely adopted in Western countries. However, financial planning is never one-size-fits-all—especially when we talk about a diverse country like India.

Why Budgeting Matters in India

India has a young working population, rising aspirations, a growing middle class, and increasing financial awareness. Yet, many individuals struggle with:

- Lack of emergency funds

- Dependence on credit cards or personal loans

- Insufficient retirement planning

- Impulsive lifestyle spending

A budgeting strategy like the 50:30:20 rule can bring discipline, helping individuals manage both short-term needs and long-term financial goals.

How Practical is the 50:30:20 Rule in India?

Let’s break down each component and analyze its practicality in the Indian scenario.

1. 50% on Needs – Can It Work in Indian Cities?

In India, “needs” often consume more than 50% of income—especially for people living in metro cities like Mumbai, Delhi, or Bangalore. Consider the following:

- Rent: A 1BHK in Mumbai or Delhi NCR can cost ₹20,000–₹40,000 per month.

- EMIs: Many working professionals spend over 30-40% of income on home loans or car loans.

- Groceries & Essentials: Monthly expenses for a family of four can range between ₹10,000–₹15,000.

- Children’s Education: Private school fees or coaching classes add further burden.

For someone earning ₹60,000 monthly after tax, limiting needs to ₹30,000 is difficult. Needs can easily take up 60–70% for urban middle-class families.

Verdict: In cities, the 50% cap on needs may not be realistic unless you have minimal debt and a frugal lifestyle.

2. 30% on Wants – A Luxury or Reality?

The ‘wants’ segment is where many Indians overspend, especially in the age of social media influence, online shopping, food delivery apps, and frequent travel.

Typical Indian wants include:

- Zomato/Swiggy orders

- Amazon & Myntra shopping

- Multiplex outings

- Short weekend getaways

- Gym or club memberships

For the upper-middle class or DINK (Double Income, No Kids) households, 30% on wants might seem doable. But for a single-income family or a fresher with limited salary, even 10-15% may feel like a luxury.

Verdict: The 30% allocation on wants is generous and may need to be trimmed for individuals with tight budgets.

3. 20% on Savings – The Most Critical Yet Ignored Segment

This part of the rule is the most crucial—and surprisingly the most neglected in India. According to various surveys, a large portion of Indian youth does not save enough or plan for retirement.

A good financial plan should include:

- SIPs in mutual funds

- PPF or EPF contributions

- Term and health insurance

- Emergency fund (3–6 months of expenses)

- Goal-based savings (child’s education, marriage, etc.)

While salaried employees with EPF contributions have some form of savings, those in the gig economy or self-employed often skip this entirely.

Verdict: Saving at least 20% is non-negotiable in India, considering inflation, rising healthcare costs, and the lack of social security.

When the 50:30:20 Rule May Work in India

- Young professionals living with parents and fewer responsibilities.

- Dual-income households where expenses are shared.

- Tier 2 & Tier 3 city dwellers, where cost of living is lower.

- Digitally-savvy individuals using UPI, expense trackers, and mutual funds.

In such scenarios, the rule can help inculcate discipline and offer a structured path to wealth creation.

When It Might Not Work

- Families with high EMIs or debt obligations.

- Individuals supporting multiple dependents (parents, kids).

- Low-income earners struggling to meet basic needs.

- Urban dwellers with high rent and transport costs.

In these cases, a customized budget ratio—like 60:20:20 or even 70:10:20—might be more practical, with savings kept consistent.

Tips to Apply the Rule in Indian Context

- Adjust the percentages: Start with 60:20:20 or 70:15:15 and work toward 50:30:20 as income increases.

- Track expenses monthly using apps like Walnut, MoneyView, or Excel sheets.

- Automate savings via SIPs, recurring deposits, or NPS contributions.

- Cut discretionary spending gradually – cancel unused subscriptions, reduce dining out, etc.

- Set financial goals – Down payment, emergency fund, kids’ education, retirement corpus.

Conclusion: Should You Follow the 50:30:20 Rule in India?

The 50:30:20 budgeting rule is a good starting point, especially for beginners. It offers a clear framework for allocating your income wisely. However, in the Indian context, it may need tweaking based on income level, city of residence, family structure, and liabilities.

The key takeaway? Whether it’s 50:30:20 or 60:20:20, consistent savings and mindful spending should always be the cornerstone of your personal financial planning.