Marriage is not just the union of two hearts, but also the merging of two financial lives. For newly married couples in India, planning finances together is one of the most important (and often overlooked) steps toward building a stable and fulfilling future.

Whether you’re in a love marriage or arranged marriage, starting your financial journey as a team sets the tone for future financial success and helps avoid misunderstandings. This guide offers practical and easy-to-follow financial planning tips tailored for newlyweds in India.

Why Financial Planning Matters for Couples

- Helps set clear financial goals as a couple

- Builds trust and transparency

- Avoids future money-related conflicts

- Enables smart decisions on spending, saving, and investing

- Ensures financial security and independence

Step-by-Step Guide to Financial Planning for Newlyweds

1. Start with an Honest Financial Discussion

Before diving into planning, sit together and discuss:

- Income details (salary, side income)

- Existing debts or loans (student loans, EMIs)

- Savings and investments

- Spending habits

- Personal financial goals

Why it matters: Transparency creates a strong foundation. You’re now a team, so financial secrecy can lead to trust issues later.

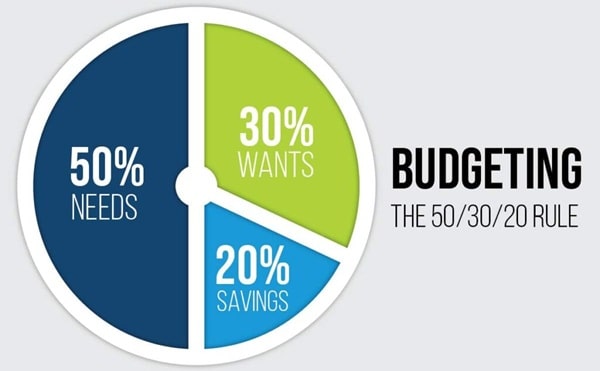

2. Create a Joint Monthly Budget

Plan your combined monthly budget based on your lifestyle and responsibilities. Cover all categories:

- Rent or home EMI

- Groceries & utilities

- Dining, entertainment, and travel

- Insurance premiums

- Loan EMIs

- Family support (if needed)

- Savings & investments

You can use budgeting apps like Walnut, Money Manager, or Excel sheets to track and manage expenses together.

3. Decide on Joint vs. Individual Accounts

Newlyweds often face this question: Should we open a joint bank account?

- Joint account is good for shared expenses like rent, utilities, travel, etc.

- Keep your individual accounts for personal spending and independence.

- Optionally, create a third account for savings and investments.

Best practice: Contribute a fixed amount (say, 60% of salary) into the joint account for household needs, and retain the rest in personal accounts.

4. Build an Emergency Fund Together

Life is unpredictable. You or your spouse could face job loss, health emergencies, or unexpected expenses.

- Save at least 3–6 months’ worth of combined household expenses.

- Keep it in a liquid mutual fund or high-interest savings account.

- Avoid using it for travel or luxury spending.

5. Buy Health and Term Insurance

If not already done:

- Buy family floater health insurance for both partners.

- Consider term insurance (life cover) especially if you have dependents or loans.

- Add health riders like maternity cover (if you plan to start a family soon).

Tip: Do not depend solely on employer-provided insurance—it’s valid only until you’re employed.

6. Align Your Financial Goals

List out your short-term and long-term goals:

| Short-Term Goals (1–3 years) | Long-Term Goals (5+ years) |

| Buy a vehicle | Buy a house |

| Vacation/travel fund | Retirement planning |

| Home setup/furniture | Child education fund |

Start investing accordingly:

- Use SIPs in mutual funds for long-term goals

- Use recurring deposits or short-term funds for short-term goals

7. Plan for Big Expenses in Advance

Whether it’s a home purchase, childbirth, or anniversary trip abroad, plan early. Allocate money monthly so you don’t fall into debt or loan traps later.

Tip: Avoid using credit cards or personal loans for big purchases. If necessary, opt for low-interest options and pay timely.

8. Distribute Financial Responsibilities

Divide responsibilities based on interest and skill:

- One partner tracks expenses

- The other manages investments

- Both sit down monthly to review

This avoids overburdening one person and keeps both partners involved.

9. Stay Away from Lifestyle Inflation

Newly married couples often fall into the trap of:

- Eating out too often

- Buying the latest gadgets on EMI

- Booking frequent vacations

While enjoyment is important, set limits. Lifestyle inflation can destroy your savings habit early in life.

10. Review and Reassess Regularly

As life changes, so should your financial plan. Review every 6–12 months to check:

- Are you meeting your savings targets?

- Any new expenses or responsibilities?

- Do you need to adjust your goals or SIPs?

Smart Financial Tips for Newly Married Couples in India

- Start a SIP early—even ₹2,000/month can grow big over time.

- Use cashback credit cards for planned spending, but pay in full monthly.

- Invest bonuses or gifts, don’t just spend them.

- Don’t compare your lifestyle to others (especially on social media).

- Learn together—watch YouTube finance channels or attend webinars.

Conclusion

Money may not buy love, but poor financial planning can definitely create stress in a relationship. Financial compatibility is just as important as emotional compatibility in marriage.

By planning finances early and together, newly married couples in India can:

- Achieve their dreams faster

- Avoid debt traps

- Build wealth and peace of mind

- Strengthen their bond through shared responsibilities

Remember: The goal isn’t just financial growth—it’s to grow together.